Crypto predictions

Cryptocurrency is a dynamic and ever-changing market, making predictions about its future both exciting and challenging. Whether you're a seasoned investor or a curious beginner, staying informed about the latest trends and forecasts is crucial for making informed decisions. To help you navigate the world of crypto predictions, we have compiled a list of 4 articles that offer valuable insights and analysis on what the future may hold for various digital currencies.

Top 5 Cryptocurrencies to Watch in 2022

Cryptocurrency enthusiasts and investors are always on the lookout for the next big thing in the ever-evolving digital asset space. In 2022, five cryptocurrencies are particularly catching the attention of market watchers. These include Bitcoin, Ethereum, Solana, Cardano, and Avalanche.

Bitcoin, the pioneer cryptocurrency, continues to be a top choice for investors looking for stability and long-term value. Its limited supply and widespread adoption make it a go-to asset for many.

Ethereum, the second-largest cryptocurrency by market capitalization, is not far behind. Its smart contract capabilities and thriving decentralized finance (DeFi) ecosystem make it a favorite among developers and users alike.

Solana, known for its high-performance blockchain and low fees, has been making waves in the crypto space. Its rapid transaction speeds and scalability have attracted a lot of attention and investment.

Cardano is another promising project that aims to bring scalability and sustainability to the blockchain industry. Its unique proof-of-stake consensus mechanism sets it apart from other cryptocurrencies.

Avalanche, with its focus on interoperability and low fees, is gaining popularity among developers building decentralized applications (dApps).

One practical use case for these cryptocurrencies is in remittances. Using these digital assets, individuals can send money across borders quickly and at

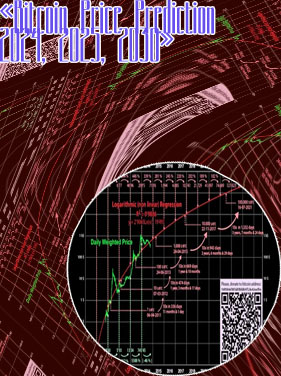

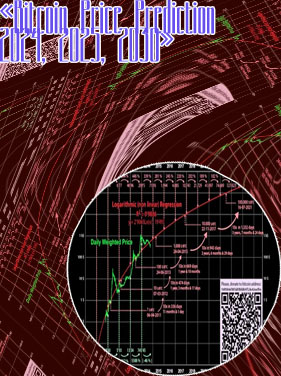

Expert Opinions: Where Will Bitcoin's Price Be by the End of the Year?

As we approach the end of the year, the future of Bitcoin's price has become a topic of great interest and speculation among investors and cryptocurrency enthusiasts worldwide. The volatility of Bitcoin's price has long been a characteristic of the digital asset, making it challenging to predict with certainty where it will stand by the end of the year.

Various experts in the field have weighed in on the matter, each offering their unique perspective on the potential price movement of Bitcoin. Some experts believe that Bitcoin's price will continue to rise steadily due to increased institutional investment and ongoing adoption. Others predict a more cautious approach, suggesting that regulatory challenges and market uncertainty may hinder significant price gains.

It is important for investors and stakeholders in the cryptocurrency market to consider these expert opinions carefully when making decisions regarding their Bitcoin investments. While no one can predict the future with absolute certainty, staying informed about the various factors that may influence Bitcoin's price is crucial for making sound financial decisions in this unpredictable market.

In conclusion, the topic of Bitcoin's price prediction by the end of the year is essential for anyone involved in the cryptocurrency market, from experienced traders to newcomers looking to enter the digital asset space. By staying informed and considering expert opinions, investors can navigate the volatility of the market with greater confidence and make informed decisions about their cryptocurrency

Analyzing the Impact of Regulation on Crypto Markets

The regulatory environment surrounding cryptocurrency markets plays a crucial role in shaping the behavior of investors and the overall stability of these emerging digital assets. Regulations imposed by governments and financial authorities can have a profound impact on the growth and development of the crypto industry. Here are some key points to consider when analyzing the impact of regulation on crypto markets:

-

Market Volatility: Regulatory announcements or actions related to cryptocurrencies can trigger significant price swings and increased volatility in the market. Uncertainty stemming from regulatory changes often leads to sharp fluctuations in the value of digital assets.

-

Investor Confidence: Clear and consistent regulations can help boost investor confidence in the crypto market. By providing a transparent framework for trading and investing in cryptocurrencies, regulators can attract more mainstream investors and institutional players to the space.

-

Compliance Costs: Compliance with regulatory requirements can be a significant burden for cryptocurrency exchanges and other service providers. The costs associated with ensuring compliance with anti-money laundering (AML) and know your customer (KYC) regulations can impact the profitability of businesses operating in the crypto sector.

-

Innovation and Growth: While regulations can introduce challenges for crypto businesses, they can also foster innovation and responsible growth within the industry. Well-crafted regulations can help legitimize the crypto market and pave the way for new products and services to

The Rise of NFTs: A Game Changer for the Crypto Industry?

The rise of Non-Fungible Tokens (NFTs) has indeed been a game changer for the crypto industry in recent years. NFTs are unique digital assets that are indivisible and cannot be replicated, making them one-of-a-kind items in the digital world. This uniqueness has led to a surge in interest and investment in NFTs, with some artworks selling for millions of dollars at auctions.

One of the most famous NFT sales was that of Beeple's digital artwork "Everydays: The First 5000 Days," which sold for a staggering million at Christie's auction house in March 2021. This sale brought NFTs into the mainstream spotlight and attracted attention from artists, collectors, and investors worldwide.

The concept of NFTs has also opened up new possibilities for content creators, enabling them to tokenize their work and sell it directly to buyers without the need for traditional intermediaries. This has revolutionized the art industry, allowing artists to reach a global audience and monetize their creations in ways previously thought impossible.

Moreover, NFTs have extended beyond the art world to other industries such as music, gaming, fashion, and real estate, offering limitless opportunities for digital ownership and innovation. As more businesses and individuals embrace NFTs